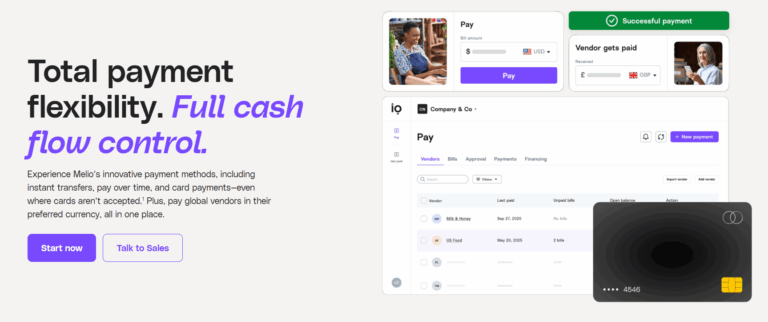

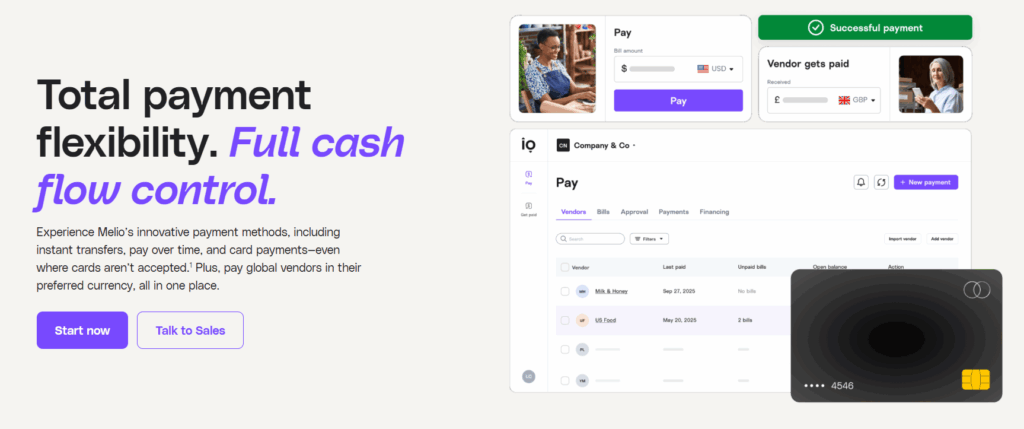

If you’re a small or medium business owner, an accountant, or someone who juggles both sending and receiving payments, you know how painful it is to manage bill pay, invoices, approvals, and everything in between. That’s where Melio steps in — and after in-depth testing, research, and real-world trials, I can confidently say Melio isn’t just another fintech tool. It might just be the productivity & cash-flow booster your business needs.

👉 Try Melio for free today via this link: Sign up here

What Is Melio — In Depth

Melio is a U.S.-based digital platform focused on accounts payable (AP) and accounts receivable (AR) for small businesses. It provides a unified dashboard where you can:

- Pay vendors, contractors, service providers

- Send invoices to clients or customers

- Get paid via card or bank

- Manage approvals, assign team roles, and keep vendor records

- Sync with your accounting software (QuickBooks, Xero)

What truly sets Melio apart is its dual functionality — it handles both outgoing payments and incoming invoices in one place. This simplifies workflow, increases transparency, and helps you run your business more efficiently.

🔗 Ready to streamline your business payments? Start with Melio here: Sign up now

Standout Features & Why They Matter

| Feature | What It Does | Why It Matters |

|---|---|---|

| Bill Scanning & Smart Capture | Upload or forward bills by email. Melio reads and fills in the payment details automatically. | Saves you time and reduces manual errors. |

| Batch & Group Payments | Pay multiple bills or group vendor payments in one transaction. | Minimizes admin tasks and saves transaction fees. |

| Approval Workflows | Assign roles, set permissions, and require approvals for larger payments. | Prevents errors and fraud as your team grows. |

| Accounting Integrations | Seamlessly syncs with QuickBooks and Xero. | Keeps your books clean and eliminates double entry. |

| Flexible Payment Options | Pay via ACH, card, or check. Even pay vendors with your credit card, even if they don’t accept them. | Improves cash flow while giving vendors what they want. |

| Custom Invoicing & Get Paid Tools | Create branded invoices with payment links. | Helps you look professional and get paid faster. |

| Security & Compliance | SOC2, 2FA, bank-level encryption. | Gives you peace of mind when handling sensitive payment data. |

| International Payments | Pay vendors overseas in supported currencies. | Simplifies global vendor management. |

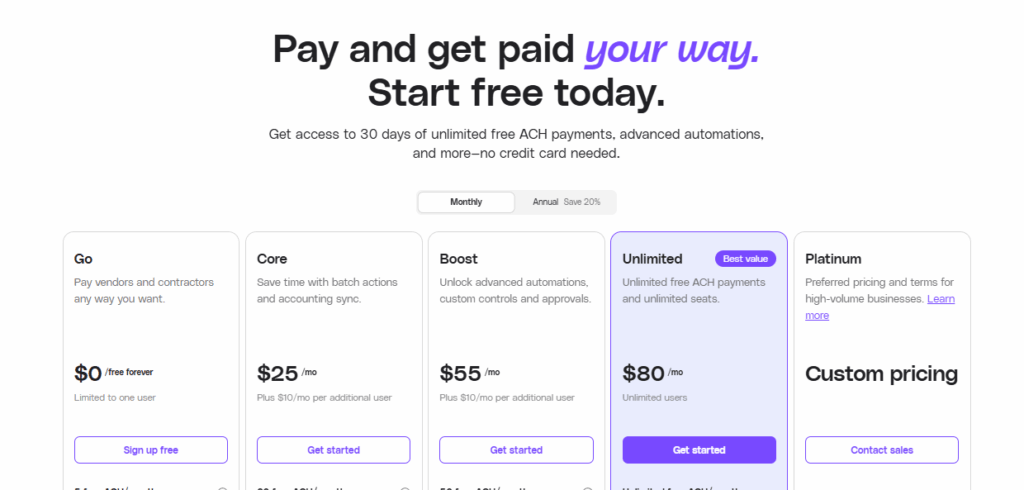

Plans & Pricing

Melio offers a freemium model with optional paid plans as your needs grow.

Free Plan (Go) – $0/month

- Send up to 5 free ACH payments/month

- Create and send invoices

- Basic accounting integrations

Core Plan – ~$25/month

- More free ACH transactions

- Batch payments

- Approval workflows

- 1099 management

Boost Plan – ~$55/month

- More automation

- More ACH payments

- Priority support

Unlimited Plan – ~$80/month

- Unlimited users

- Full automation suite

- Dedicated onboarding and support

💡 You can try most of Melio's premium features with a free 30‑day trial — no risk.

🎯 Start your trial today via this link: Click to get started

Real Business Benefits

Implementing Melio in your business could lead to:

- Time savings: Automate bill capture and reduce data entry.

- Better cash flow: Pay by credit card even when vendors don't accept them.

- Reduced errors: With approval workflows and synced accounting, your books stay clean.

- Faster payments received: Your clients can pay you via multiple methods using branded invoices.

- Improved professionalism: With your branding on invoices and payments handled smoothly.

Things to Keep in Mind

No tool is perfect — here are a few considerations:

- Fees: Some transactions (credit cards, expedited payments) incur a small fee. ACH payments are free up to your monthly limit.

- Feature limitations by plan: Some advanced functions require a paid tier.

- Learning curve: The platform is easy to use, but features like workflows may require brief onboarding.

- Regional availability: Currently, Melio is optimized for U.S.-based businesses.

Who Should Use Melio?

✅ Perfect for:

- Small to mid-sized U.S.-based businesses

- Companies who invoice clients and pay contractors

- Businesses with cash flow constraints needing flexible payment options

- Firms using QuickBooks or Xero

- Bookkeepers and accounting professionals managing multiple clients

❌ May not be ideal if:

- You’re outside the U.S. and need full international coverage

- You never need AP/AR automation or approval flows

- You only have 1-2 vendors or invoices per month and don’t mind doing it manually

Final Verdict

Melio is a modern, robust, and user-friendly tool that replaces old-school check-writing, tedious spreadsheets, and disconnected payment systems. It brings real value — not just in features, but in time saved, cash flow unlocked, and operations streamlined.

It’s hard to find an all-in-one payment platform that combines flexibility, ease of use, accounting sync, and scalable workflows — but Melio checks every box.

✅ Highly recommended for modern small businesses that want to simplify how they pay and get paid.

🚀 Join thousands of businesses already using Melio — sign up via this link:

👉 Get started with Melio

Optional Call-to-Action Block (you can place this at the end of your article or sidebar):

💼 Tired of juggling bills and invoices in spreadsheets?

Start using Melio — the smarter way to manage payments.

🔗 Click here to sign up for free